PriceSpy: Black Friday Data & Trends Report 2022

PriceSpy

PriceSpy

Updated: 16 November 2022

PriceSpy

PriceSpy

Updated: 16 November 2022

Black Fridays in recent years have been somewhat disrupted due to the Covid-19 pandemic. Black Friday this year is going to be another subdued affair - this time due to the ongoing cost of living crisis.

PriceSpy’s Black Friday Data & Trends Report 2022 touches upon the impact so far of the cost of living crisis in the UK, then looks back on previous years to understand what both shoppers and retailers can expect from Black Friday 2022. Plus, a plea to retailers to avoid the practice of fake sales in order to help both retailers and shoppers to get the most out of the sales day.

No-one is immune to cost of living pressures

In a survey commissioned by PriceSpy in September 2022, almost nine in 10 people (88%) - across all income brackets - said they are worried by the current situation. Perhaps unsurprisingly, PriceSpy’s research indicates that people are actively changing their lifestyle and their usual shopping habits in direct response to this.

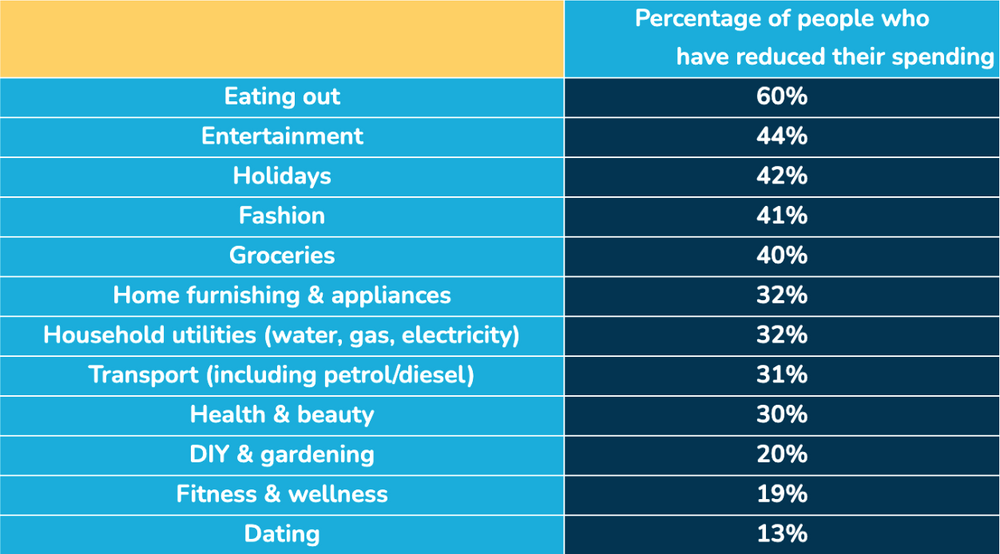

In response to the cost of living crisis, people have reduced their spending on…

A fifth (21%) of people have ruled themselves out of participating in sales days like Black Friday, with one of the most common reasons being that they can’t afford to / need to save money (35%).

That said, almost three in 10 (28%) Brits do plan to shop on Black Friday. So, with that in mind, let’s explore recent Black Friday trends.

Purchase intent traditionally peaks on Black Friday

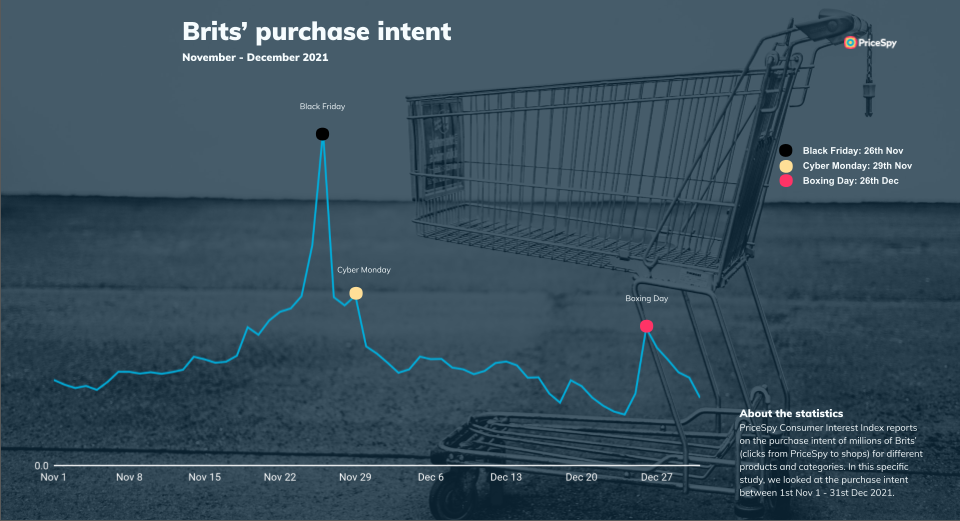

Black Friday is no longer a one day affair. Retailers are beginning their sales much earlier - in some cases from the start of November - and Brits’ purchase intent is consequently reflecting this. Last year, purchase interest on PriceSpy began building at the end of the first week of November and then peaked on Black Friday. Purchase intent then dropped slightly (but remained above pre-November levels) and stayed steady until another noticeable peak on Boxing Day.

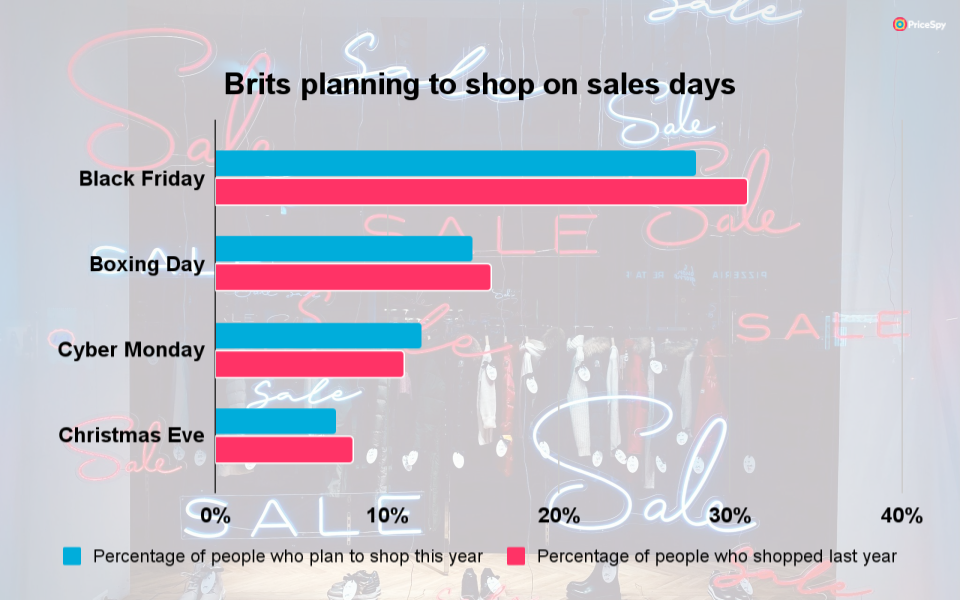

There’s likely to be a very similar trend this year, according to a survey* of UK consumers conducted on behalf of PriceSpy. When asked which - if any - sales days they intend to shop on this year, Black Friday and Boxing Day came out top. However (and we’ll explore this in more detail further down in this report) there is a notable drop in the number of people planning on shopping on sales days full stop, compared to 2021 when people’s spending power - and appetite - was stronger than it is now.

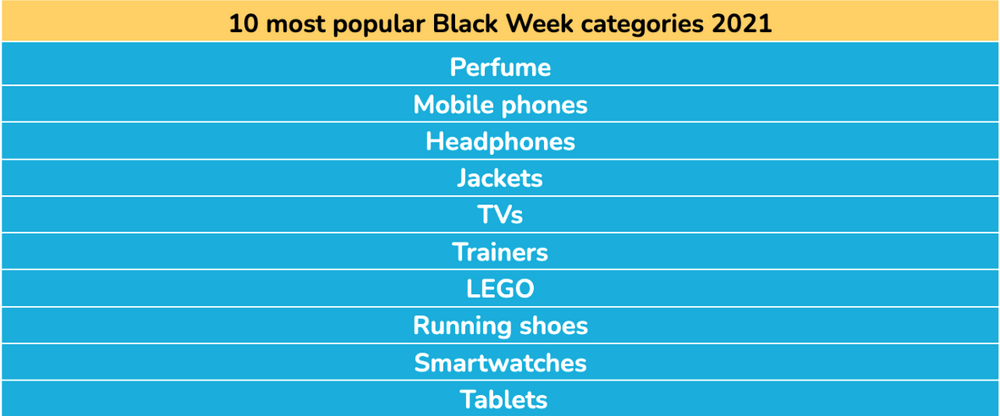

Perfume, mobile phones and headphones most popular on Black Friday

When thinking about what people might be buying on Black Friday this year, it’s worth taking a look at Black Friday 2021 as a starting point. During Black Week (the Sunday before Black Friday to the Sunday after Black Friday), the most popular product categories on PriceSpy were:

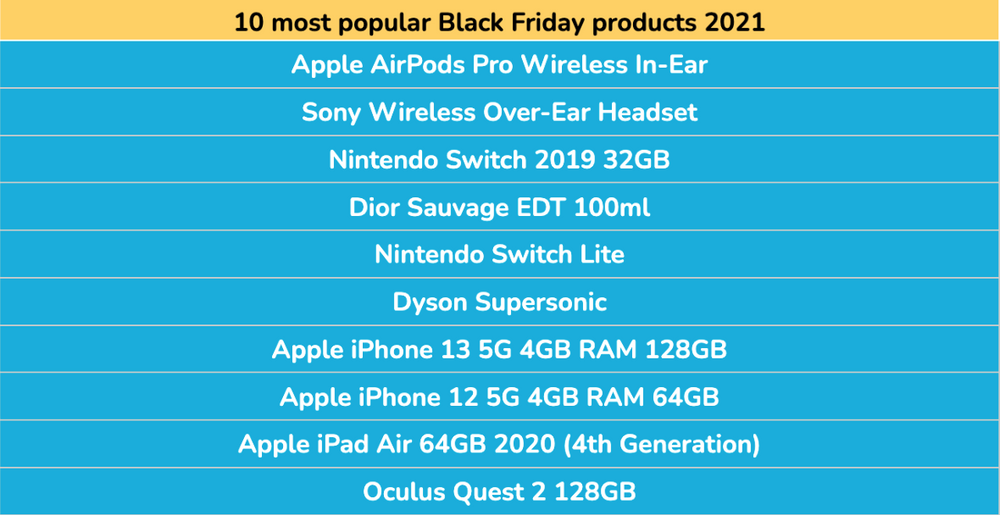

And the most popular products on Black Friday itself were:

Black Friday is the cheapest shopping day of the year, on average

On average over the last three Black Fridays, over four in 10 (42%) products were cheaper on Black Friday compared to the start of November. With average savings of just over a fifth (21%) when looking at products with discounts above 10%.

PriceSpy’s Price Index below demonstrates how, across the whole site, the biggest number of products were at their lowest respective prices all year on Black Friday last year.

Biggest savings to be found on underwear, sex toys and furniture

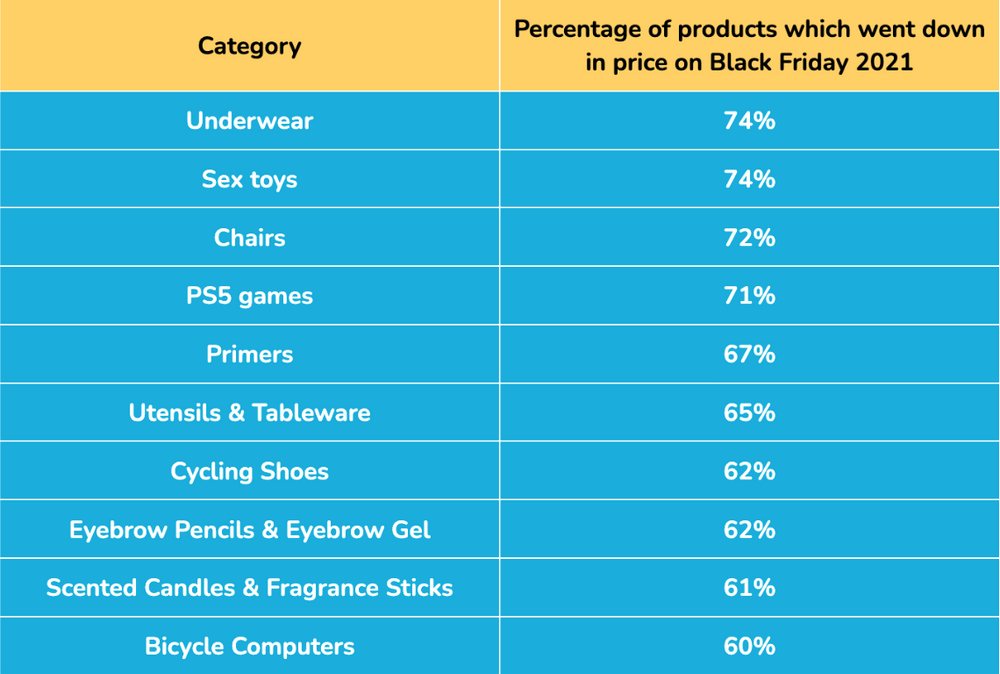

On Black Friday 2021, here were the best categories for savings (compared to the start of November):

However, despite the fanfare around big discounts, Black Friday has been plagued by fake sales in recent years

’Fake sales’ refers to the practice of hiking prices before a key sales period, to then reduce the price and display a saving based on the difference against the previously inflated price.

On average over the last three Black Fridays (2019, 2020, 2021), 13% of products on PriceSpy increased in price between 1st October and the Sunday before Black Friday, to then be ‘reduced’ on Black Friday. A demonstration of ‘fake sales’ in action.

From a slightly different perspective, many products are simply more expensive on Black Friday full stop. On average over the last three Black Fridays over a quarter (26%) of products were more expensive on Black Friday compared to the start of November.

And, for those that could wait, almost one in five (19%) products were cheaper two weeks after Black Friday than they were on the day.

Smart shopping tips

Shoppers are becoming savvier

Black Friday ‘sales’ are not all they seem - and shoppers are beginning to get wise to this.

Furthermore, almost a fifth (17%) of people say they’ve regretted a purchase they’ve made during Black Friday in the past for reasons including:

PriceSpy is calling for an end to fake deals

Looking closer to Black Friday 2022, PriceSpy data shows that shops have been steadily increasing prices in advance of Black Friday, with almost a quarter (24%) of products rising in price in October - 12% increasing by 10% or more.

Based on insights from previous years, this is an early indicator of retailers preparing to slash prices on Black Friday and promote discounts which are bigger than they really are. And potentially on a wider scale than previous years.

PriceSpy’s data shows that the majority of retailers offer some of their best deals of the year on Black Friday, giving consumers a real opportunity to get genuine bargains. However there are shops that engage in fake deals and bring into disrepute the credibility of the sales event. PriceSpy is calling on retailers to stop promoting fake sales and instead be more transparent with their pricing in marketing this Black Friday - and beyond.

Methodology

This report is based on a survey of 2,061 consumers in the UK undertaken by Censuswide, on behalf of PriceSpy, between 30th September - 3rd October 2022

PriceSpy is a fully impartial, comprehensive price and product comparison service. It helps millions of consumers every month to find, discover, research and compare products.

Read more